Reviewing the February 2024 Baseline for USDA Farm and Nutrition Programs

Key Takeaways

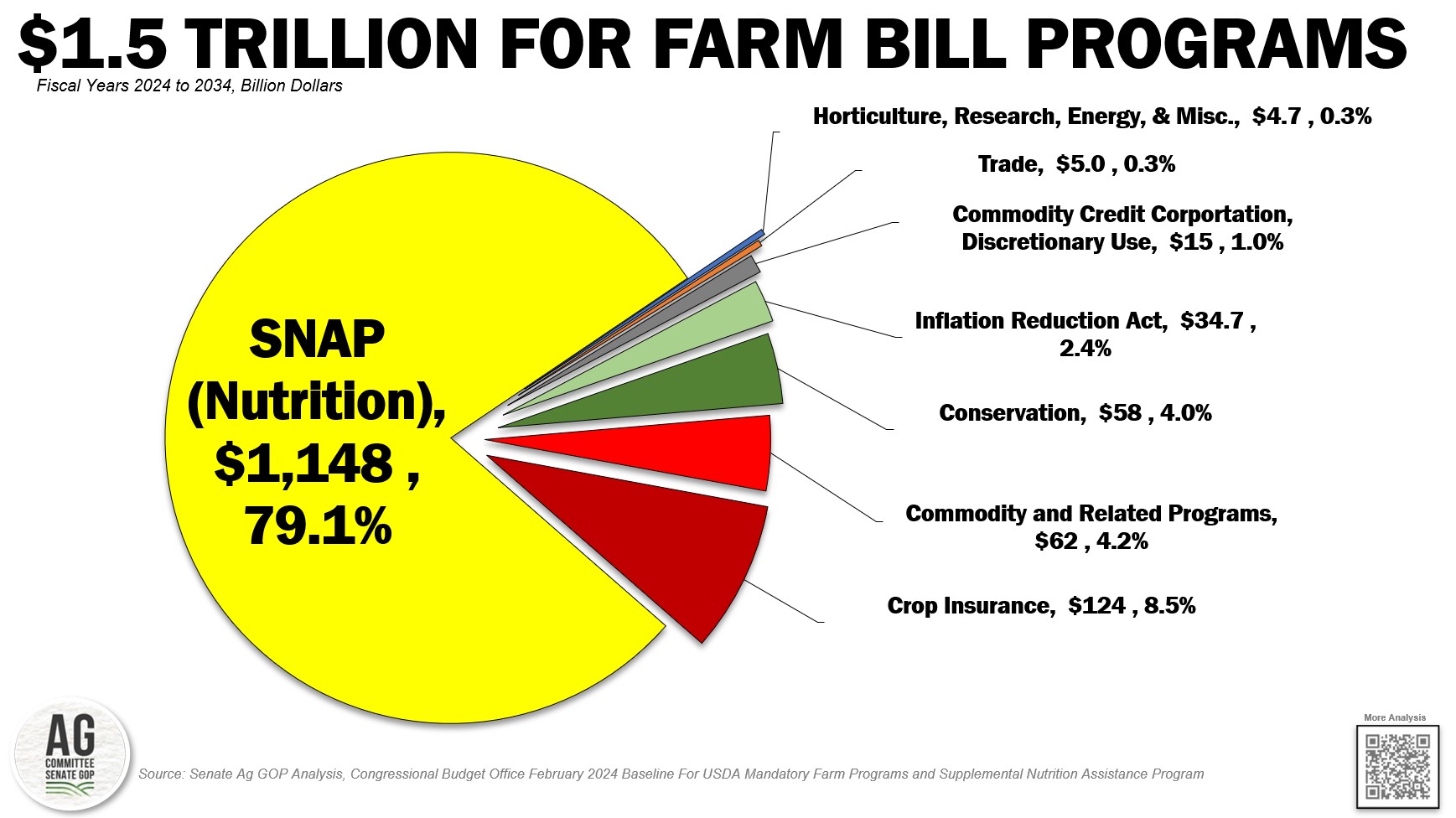

- The Congressional Budget Office’s February 2024 baseline for USDA Mandatory Farm Programs and the Supplemental Nutrition Assistance Program revealed projected outlays for farm bill-related programs at $1.46 trillion over the 10-year window from fiscal years 2025 to 2034 – down 3.5% from the previous 10-year baseline of $1.5 trillion.

- The May 2023 baseline remains the farm bill scoring baseline until directed otherwise by the budget committees. In addition to this February baseline, CBO will release a new spring baseline following the release of the President’s fiscal year 2025 budget request. It is possible, at the direction of the budget committees and in consultation with the agriculture committees that proposed farm bill modifications could be scored against a baseline other than the May 2023 baseline.

While the May 2023 Congressional Budget Office (CBO) baselines for USDA Mandatory Farm Programs and the Supplemental Nutrition Assistance Program (SNAP) currently remains the farm bill scoring baseline, CBO recently released February 2024 baselines for farm programs and SNAP to provide updated spending projections through fiscal year 2034. Combined, mandatory farm programs and SNAP are projected to total $1.46 trillion over the 10-year window from fiscal years 2025 to 2034, down 3.9% or $59 billion from CBO’s May 2023 10-year baseline of $1.51 trillion during fiscal years 2024 to 2033.

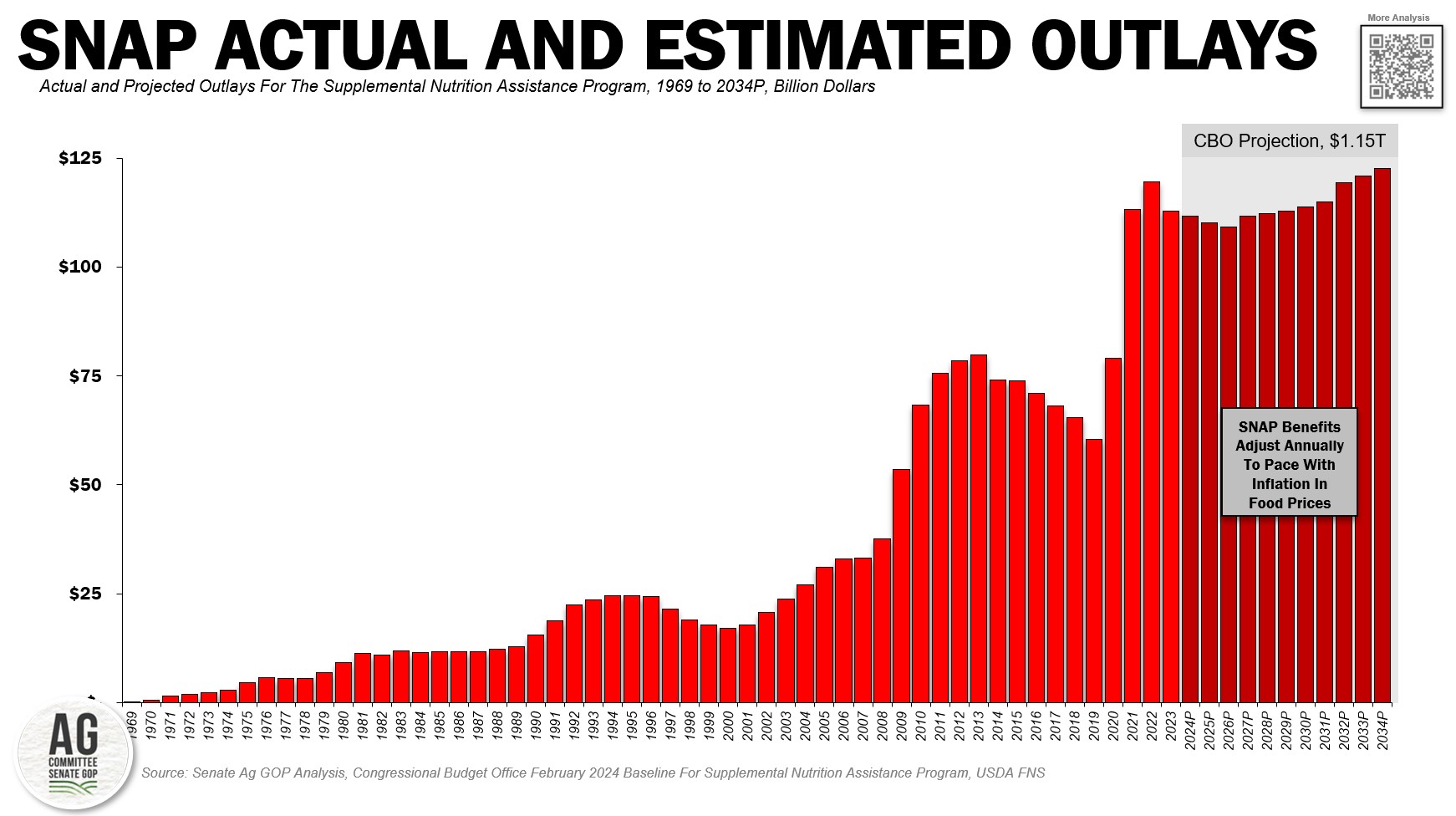

Supplemental Nutrition Assistance Program

At nearly 80% of total farm bill program spending, CBO now projects 10-year SNAP outlays at $1.15 trillion, a $77 billion decrease from the May projection of $1.2 trillion (when including changes made to SNAP in the Fiscal Responsibility Act of 2023). The decline in projected SNAP outlays is due to lower participation estimates -- a decline of approximately 1 million participants per year – and a decrease in the estimated benefits per person of approximately $12 per month. Importantly, reflecting trends in overall food price inflation and other factors, projected SNAP benefits per person continue to increase in the baseline, rising from $206 per person in 2025 to nearly $260 per participant in 2035 – an increase of 26%.

While SNAP spending is projected to decline from the May 2023 baseline, SNAP spending has increased by $484 billion, or 73%, since the 2018 Farm Bill’s enactment, driven in large part by a 21% increase in SNAP benefits as part of the 2021 Thrifty Food Plan reevaluation, food price inflation, and increased program participation.

Crop Insurance, Commodity Programs, and the Commodity Credit Corporation

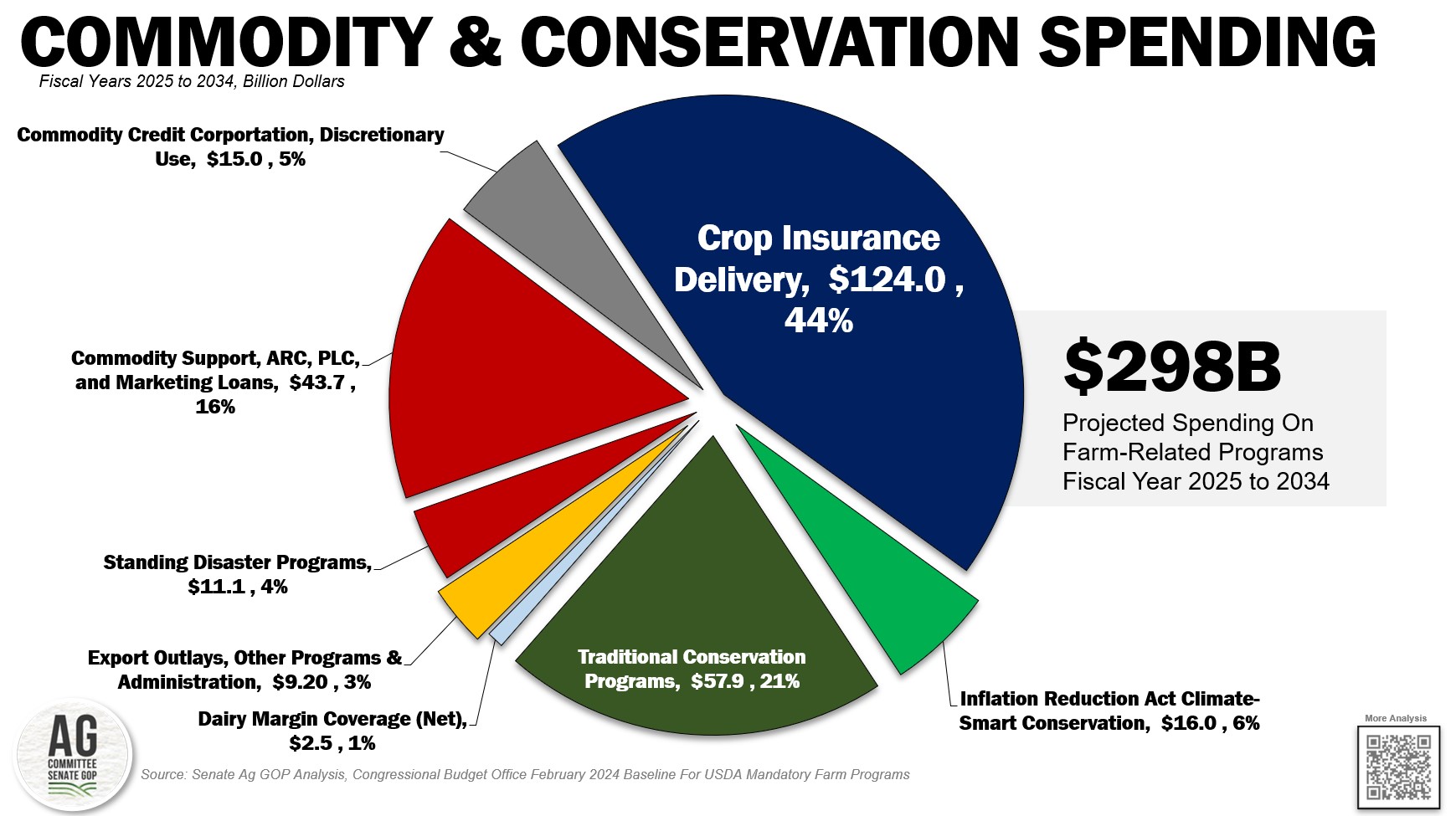

The remaining 20% of spending falls into farmer-related programs such as crop insurance, commodity support programs such as Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC), and voluntary incentive-based conservation programs such as the Environmental Quality Incentives Program or the Conservation Reserve Program (CRP).

Total outlays for crop insurance are now projected at $124 billion, a $23 billion, or 22%, increase from the May 2023 projection of $101 billion. The increase in projected crop insurance outlays is driven by higher expected crop prices and an additional 30 million acres projected to be insured each year – driven by an increase in pasture, rangeland, and forest utilization. The impact of livestock-based crop insurance policies such as Dairy Revenue Protection or Livestock Risk Protection for cattle and swine are also captured in the CBO baseline for federal crop insurance.

Commodity income support and related programs such as ARC, PLC, Dairy Margin Coverage (DMC), and livestock disaster programs, among others, are now projected to cost $57 billion over the 2025 to 2034 fiscal years (not including export outlays, other miscellaneous programs, and administration). The $7.5 billion decrease in commodity support payments is driven mainly by reduced outlays for ARC, down $2.9 billion to $15.3 billion, and PLC, down $4.8 billion to $28 billion over fiscal years 2025 to 2034. The decline in commodity program payments was driven by marginally higher crop prices in the distant years of the baseline. For example, the 10-year average soybean price increased to $10.34 per bushel compared to a May average of $9.95 per bushel, and the 10-year average all rice price increased to $14.71 per hundredweight, up from a 10-year average of $13.75 per hundredweight in the May baseline. Outlays for DMC and livestock disaster payments were mostly in line with the May projections at $2.5 billion and $11.1 billion, respectively.

In recent years USDA has used the discretionary authority of the Commodity Credit Corporation (CCC) to provide new financial resources for efforts such as the Trade Mitigation Programs, Partnerships for Climate Smart Commodities, and the Regional Agricultural Promotion Program, among others. Historically, CBO accounted for this discretionary use of the CCC at $1 billion per year, or $10 billion over 10 years. This score had remained unchanged since the May 2022 baseline. Now, to reflect the increased use of the CCC for discretionary purposes, CBO increased their projections for CCC spending from fiscal year 2025 to 2034 to $15 billion, an increase of $5 billion from the May 2023 baseline (Note: CBO also increased fiscal year 2024 CCC spending by $2 billion).

Conservation and Inflation Reduction Act Spending

Spending for voluntary incentive-based conservation programs such as CRP, EQIP, or the Conservation Stewardship Program, among others, are now projected at $58 billion, $2 billion lower than the May 2023 projection of $60 billion due to lower CRP-related outlays. The reduction in CRP outlays is attributable to increased enrollment in CRP grasslands and the lower per acre rental payments associated with these acres.

While not currently a part of the farm bill baseline, a line item many conservation stakeholders likely followed was Inflation Reduction Act (IRA) climate-smart program outlays. In the February baseline, CBO increased and shifted the pace of projected outlays for climate-smart spending authorized as part of the IRA by approximately $110 million. For the most part, CBO projected a slower pace of outlays in nearby years, with higher outlays in fiscal years 2029 to 2031. At the same time, CBO reduced projected outlays for conservation technical assistance by $101 million – leaving total IRA-related outlays $9 million higher than the score for the IRA upon enactment.

When including the IRA-related outlays for conservation programs, conservation- and climate-related outlays total $74 billion during fiscal years 2025 to 2034 – making conservation- and climate-related financial and technical assistance larger than that of commodity support programs and approximately 27% of all spending on farm-related programs in the farm bill.

Should IRA resources for conservation programs move into the farm bill, and should they be refocused to meet the local resource needs of farmers and ranchers, there remains nearly $16.5 billion in projected outlays available for reinvestment.

Impact On the Farm Bill Scoring Baseline

The question likely on the minds of many farm and nutrition policy stakeholders is: “Is this the new farm bill baseline?” The answer is not definitive.

Currently, the May 2023 CBO baseline is the scoring baseline for the next farm bill – meaning any proposed policy modifications to farm and nutrition programs in the farm bill and their impact on the U.S. deficit are being measured against the May 2023 baseline. That can change. In addition to this February 2024 baseline, CBO will issue another baseline in 2024 after the release of the President’s fiscal year 2025 budget request to Congress – now expected to be released in March.

The potential for either of the 2024 baselines to replace the May 2023 baseline as the farm bill scoring baseline will be determined by the budget committees in consultation with the agriculture committees. So, while the February 2024 baseline is not currently the farm bill baseline, it does provide an important perspective on projected farm and nutrition program spending for the next baseline – one that could supplant the May 2023 baseline as the scoring baseline for the farm bill.