Minority Analysis: The May 2023 Farm Bill Scoring Baseline

Key Takeaways

- The Congressional Budget Office’s highly anticipated May 2023 baseline is widely expected to be the 2023 Farm Bill scoring baseline – meaning any proposed policy modifications and the impact on the U.S. deficit will [likely] be measured against this baseline.

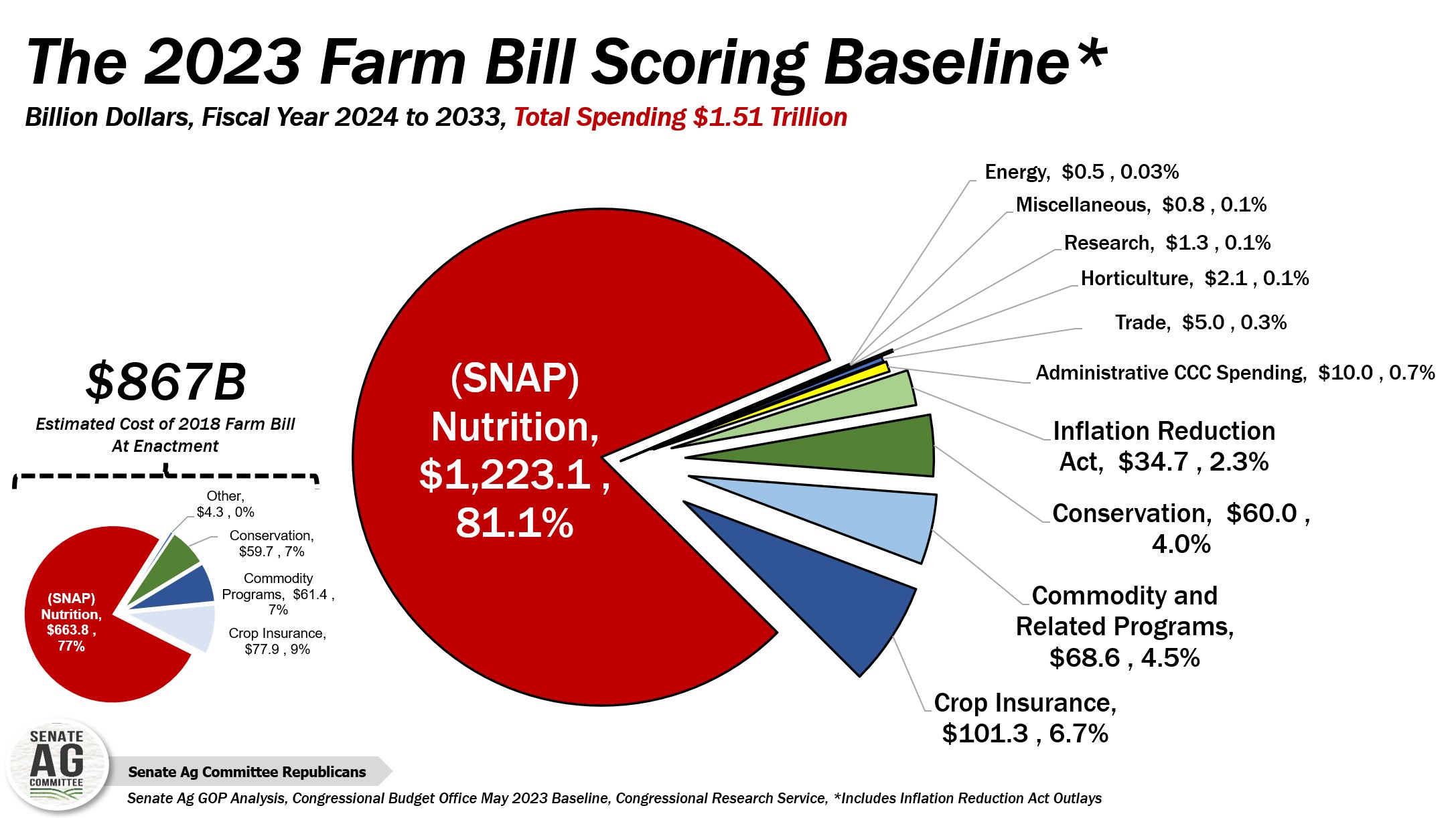

- CBO’s May baseline confirms that the 2023 Farm Bill, upon enactment, could potentially be the first trillion-dollar farm bill in U.S. history. Total spending is projected at $1.51 trillion, $31.5 billion higher than CBO’s February baseline (this total includes outlays from the Inflation Reduction Act).

- Compared to the CBO’s February baseline, total outlays for the Supplemental Nutrition Assistance Program are now projected at $1.223 trillion, nearly $18 billion higher than CBO’s February projection.

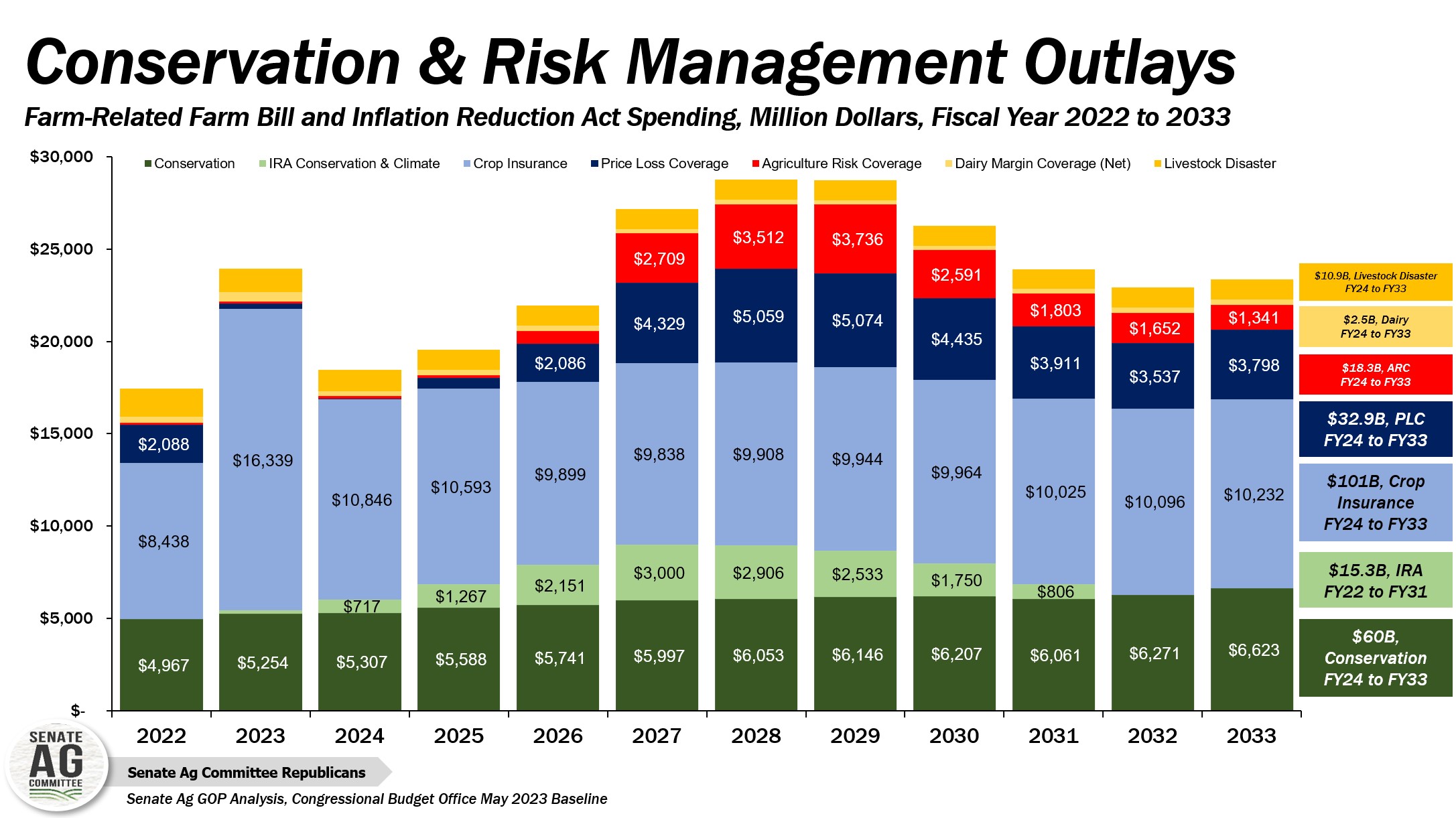

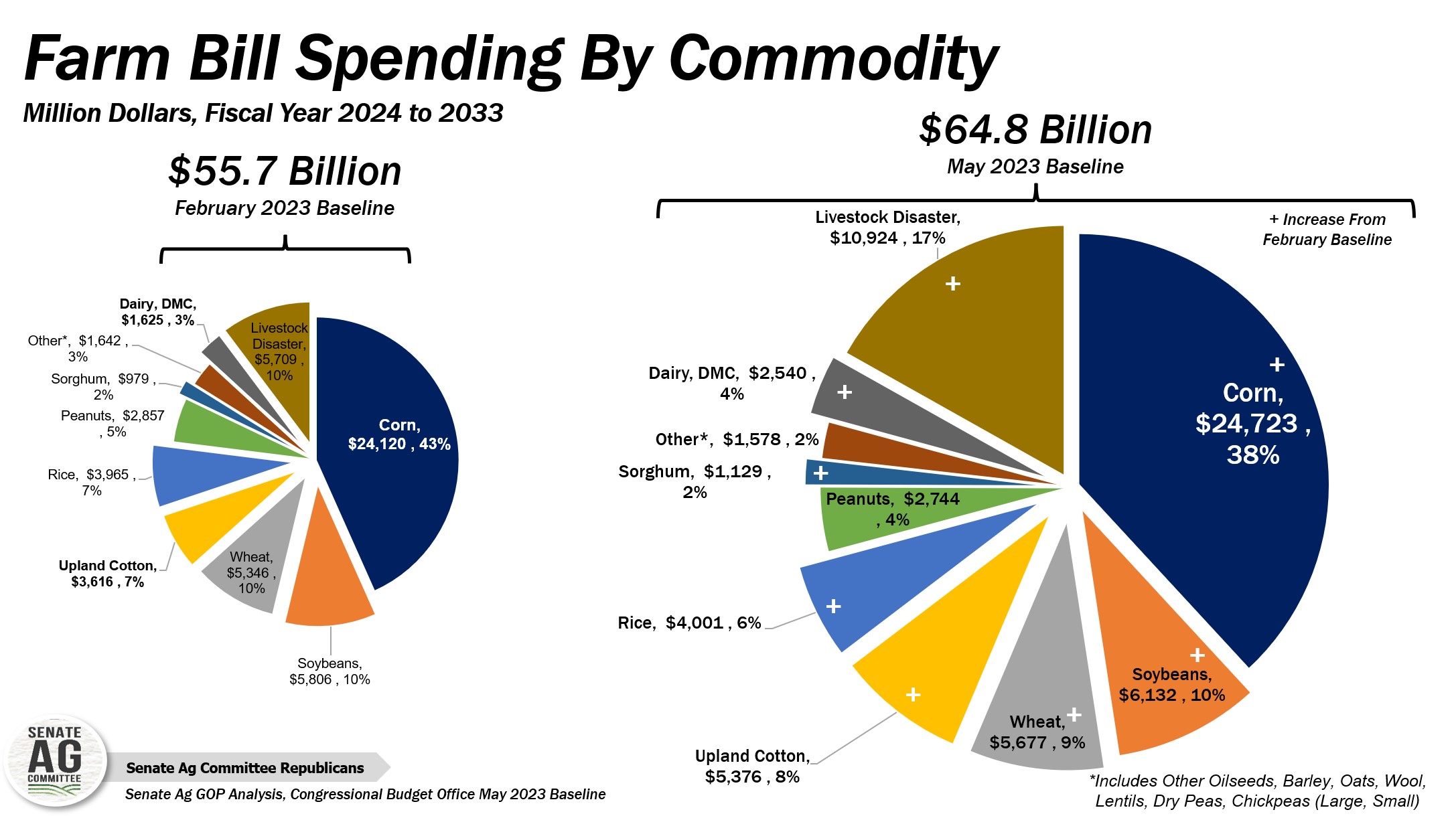

- Outlays for major commodity support program payments are projected higher due to lower seed cotton prices, lower dairy farm margins, and higher prices for some crops raising the income support level for both Agriculture Risk Coverage and Price Loss Coverage.

The Congressional Budget Office’s (CBO) recently released May 2023 baselines for USDA Mandatory Farm Programs and the Supplemental Nutrition Assistance Program (SNAP) confirm that the 2023 farm bill, upon enactment, could potentially be the first trillion-dollar farm bill in U.S. history. Total outlays across SNAP and mandatory farm programs for fiscal years 2024 to 2033 are projected at $1.51 trillion, up $31.5 billion or 2% from the February 2023 projections (this total includes Inflation Reduction Act, IRA, outlays). Compared to the cost of the 2018 farm bill at enactment of $867 billion, the 2023 farm bill will represent a $640 billion or 74% increase in spending – primarily driven by increases in SNAP outlays.

At more than 81% of total farm bill spending, CBO now projects 10-year SNAP outlays at $1.223 trillion, an increase of $18 billion from the February projection of $1.205 trillion. The increase in SNAP spending is due to an estimated increase in SNAP participation by approximately one million new participants per year – bringing average SNAP participation to an average of 39 million per year during the 2024 to 2033 fiscal years.

In addition to the increase in the 10-year farm bill baseline window, it is important to note that CBO had to adjust the May baseline since February to include increased SNAP outlays by $17.9 billion in fiscal year 2023 alone (from $127 billion to $145 billion). When including fiscal year 2023, SNAP outlays over an 11-year period total $1.37 trillion, $36 billion more than CBO’s February baseline projection.

The remaining 19% of spending falls into farmer-related programs such as crop insurance, income support programs, and voluntary incentive-based conservation programs. Total outlays for crop insurance are now projected at $101 billion, an increase of $4 billion from the February projection of $97 billion.

Spending for voluntary incentive-based conservation programs such as the Conservation Reserve Program (CRP), Environmental Quality Incentives Program, or the Conservation Stewardship Program, among others, are now projected at $60 billion, slightly higher than the February projection of $57.5 billion due to higher CRP-related outlays.

While not currently a part of the Farm Bill baseline, the IRA authorized $36.7 billion in climate-related spending for conservation, forestry, and rural development programs. Of that total, CBO’s February baseline projected total outlays at $34.6 billion – 94% of the budget authority provided by the bill. CBO’s updated baseline made no changes to outlays or the pace of outlays for the IRA funding. When including the IRA-related outlays for conservation programs, conservation- and climate-related outlays total $75B. Should IRA resources move into the farm bill, and should they remain dedicated to conservation and climate, the conservation title would surpass commodity support programs as the second-largest farm-related title in the farm bill behind crop insurance.

Commodity income support and related programs such as Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC), Dairy Margin Coverage (DMC), and livestock disaster programs, among others, are now projected to cost $69 billion over the 2024 to 2033 fiscal years. The nearly $12 billion increase in commodity support payments is due to increased outlays for ARC and PLC, DMC, livestock disaster payments, and higher interest expenses during the 10-year baseline window. Compared to the February baseline, CBO made slight upward revisions to prices of major crops such as corn, soybeans, wheat, rice, and peanuts. CBO lowered price projections for seed cotton, the all-milk price, dairy feed costs, and the DMC income-over-feed-cost margin. The impact of updated price projections on commodity-program outlays is identified below.

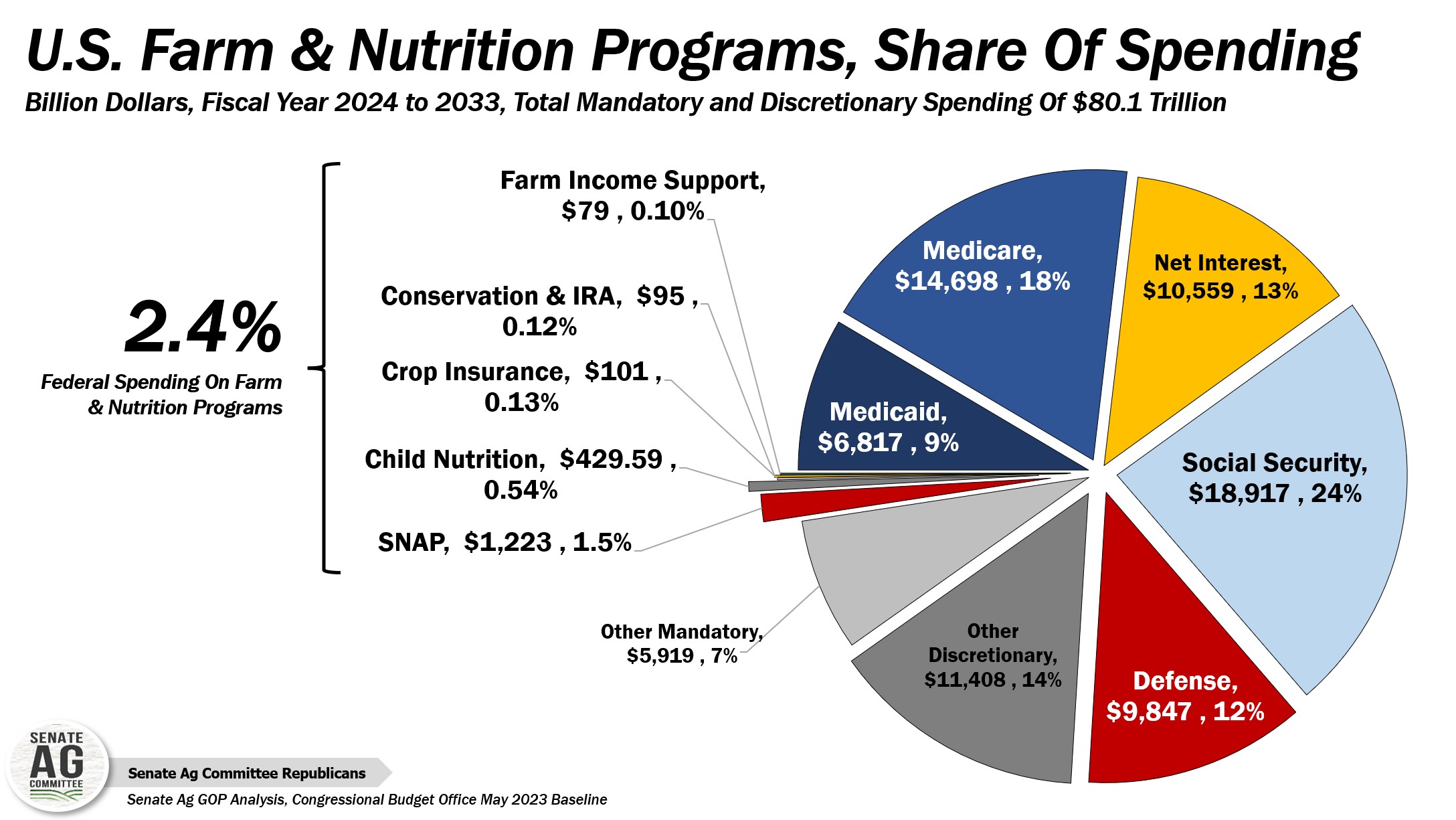

To put farm bill spending into perspective, consider that total mandatory and discretionary spending, including Medicare, Medicaid, Social Security, defense, and interest expenses, among others, are projected at $80.1 trillion for fiscal years 2024 to 2033. As a percentage of this total, agriculture- and nutrition-related programs (including Child Nutrition Programs which are not authorized by the farm bill) account for 2.4% of total outlays. Farm programs specifically, such as vital farm risk management tools and voluntary incentive-based conservation programs, are projected to represent more than three-tenths of one percent of total federal government spending.

The May 2023 CBO baseline is widely expected to be the 2023 Farm Bill scoring baseline – meaning any proposed policy modifications and the impact on the U.S. deficit will be measured against this baseline. It is possible that CBO could release another baseline in 2023, but the purpose of a late-summer baseline is generally to gain a revised perspective on the impact of mandatory and discretionary spending on the U.S. deficit -- not to change the farm bill scoring baseline.