USDA Says High Farm Production Costs Not Easing In 2024

Key Takeaways

- USDA’s first 2024 cost-of-production forecast for major field crops such as corn, soybeans, wheat, cotton, rice, and peanuts, among others, reveals that input costs are expected to remain elevated into the next growing season, at the third-highest level of all-time, and only slightly lower than the record-high reached in 2022.

- While some input cost categories like fertilizer and chemical expenses are projected to decline from 2023 to 2024, other expenses such as seed costs, labor, machinery and equipment, taxes, and insurance are expected to increase.

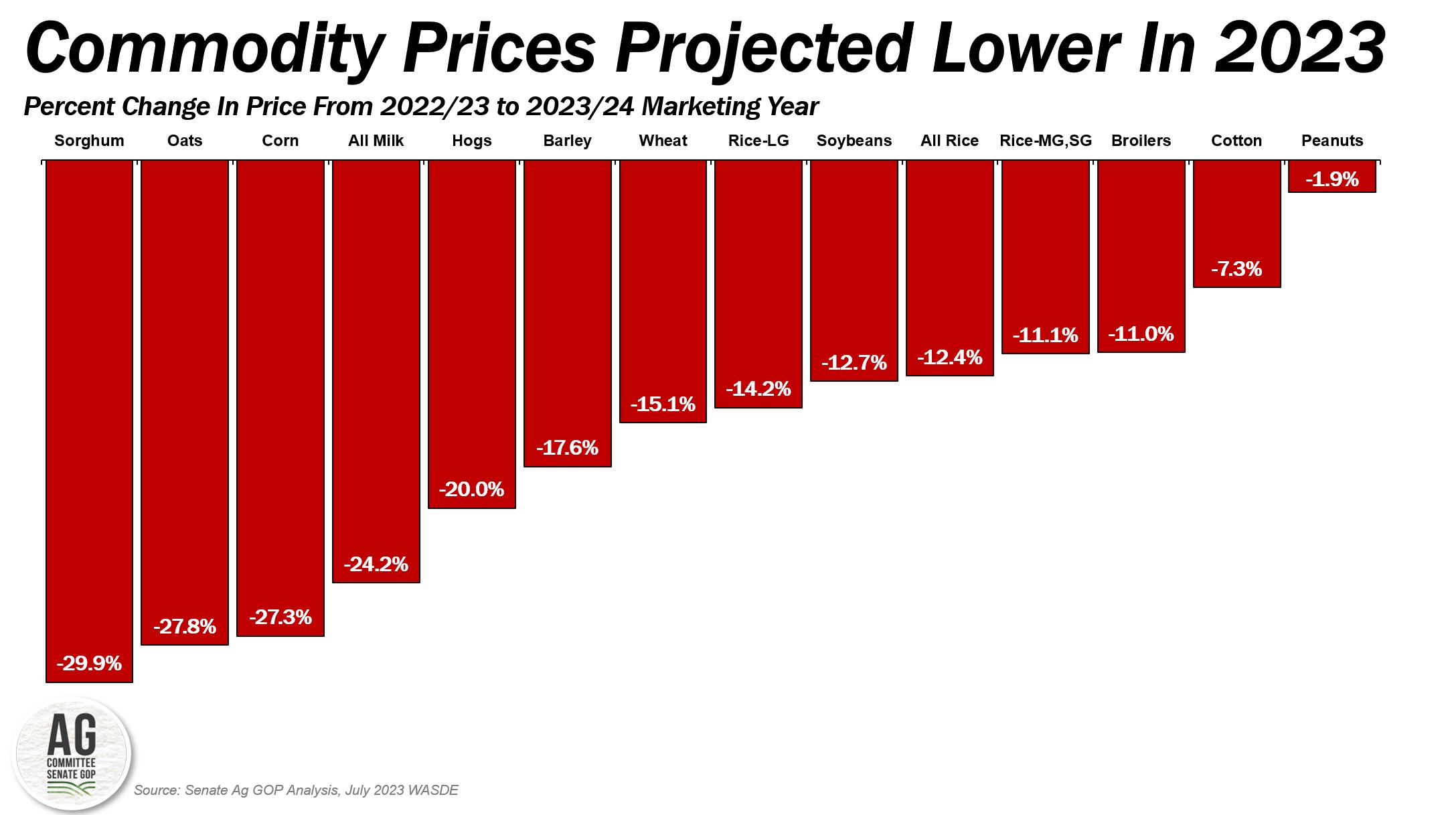

- Based on USDA’s current input cost projections, trend yields, and commodity price trends, several major field crops may experience marketing year average prices below breakeven levels this year and possibly into 2024.

- Declining crop prices and elevated input costs highlight the importance of farm management factors such as risk management, marketing, diversification, and production efficiency that can enhance income and reduce costs – and possibly contribute to more favorable or above-breakeven margins for major field crops.

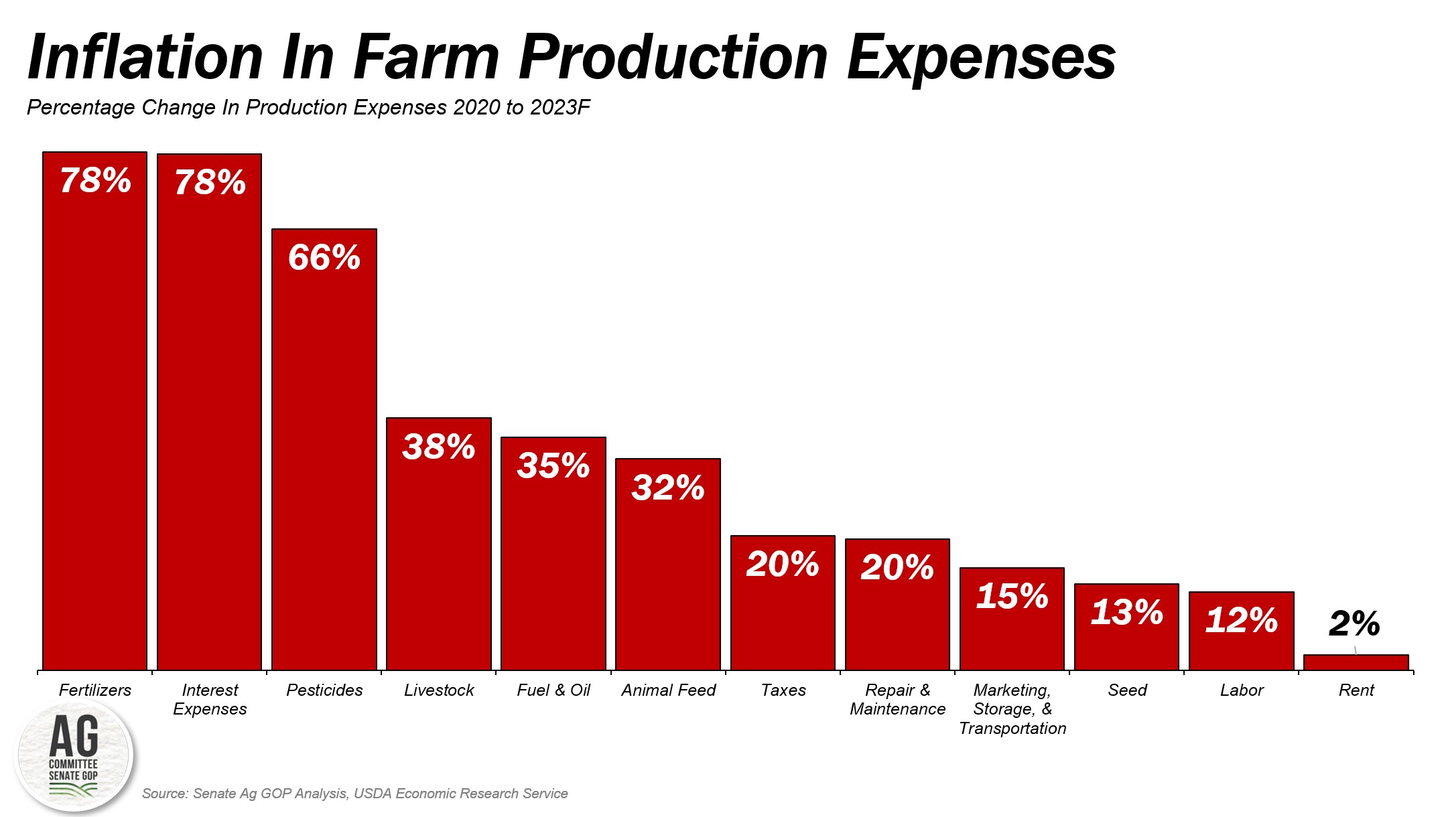

The rapid increase in the costs for agricultural inputs like fertilizer, fuel, land, machinery, labor, and financing is well documented (e.g., Revisiting Farm Production Expenses). Since 2020 the total costs paid by farmers to raise crops and care for livestock increased by more than $100 billion, or 28%, to an all-time high of $460 billion in 2023. In percentage terms, the largest increases in input costs were experienced in fertilizers, financing, crop protection tools, livestock, and fuels and oils.

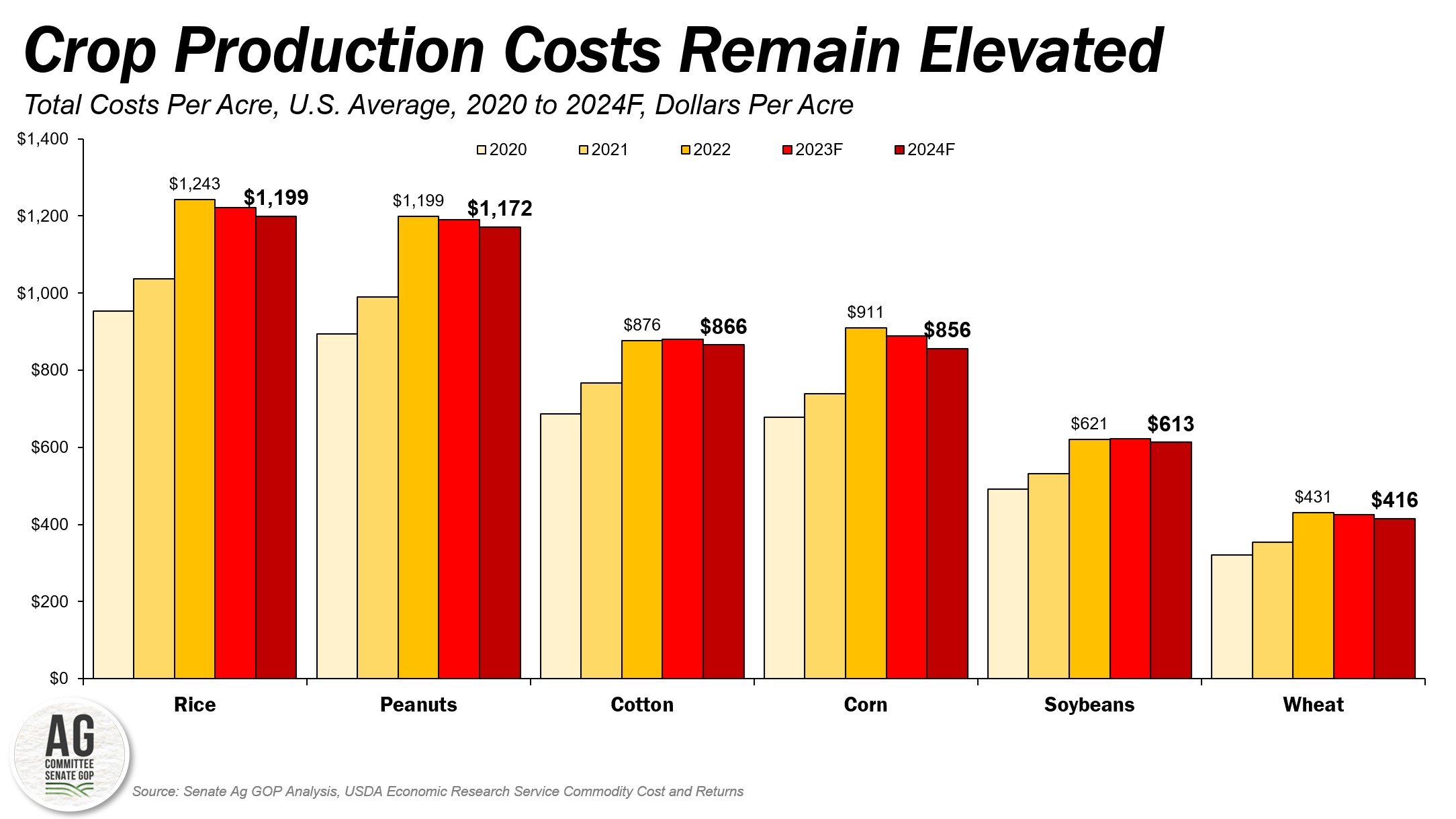

In June, USDA’s Economic Research Service released their first cost-of-production forecast for major field crops including updated projections for 2023 costs and the first look at estimated production expenses for 2024. For 2024, the cost-of-production for major field crops (e.g., corn, soybeans, wheat, cotton, rice, and peanuts) is expected to remain elevated and decline only slightly – ranging from a 3.6% decline in production costs for corn to a 1.4% decline in production costs for soybeans. Notably, input costs for the 2024 growing season are expected to be the third-highest all-time, behind only 2022’s record-high and 2023’s second-all-time high.

Across the input costs categories, from 2023 to 2024, interest expenses per acre are expected to decline by approximately 30%, fertilizer expenses are projected to decrease by 17%, chemical expenses are expected to decline by nearly 8%, and land expenses are expected to decrease by 1.4%. However, other expenses such as seed costs, labor, machinery and equipment, taxes, and insurance are expected to increase.

During 2024, the cost-of-production is expected to be the highest for rice at nearly $1,200 per acre, down 1.8% from 2023. Following rice, peanut input costs are projected at $1,172 per acre, down 1.6%, and the cotton cost-of-production is forecast at $866 per acre, down 1.6%. The cost to produce one acre of corn is projected at $856 per acre, down 3.6%, and for soybeans the projected cost of production is $613 per acre, down 1.4%. Among the major field crops, the wheat cost-of-production is forecast to be the lowest at $416 per acre, down 2.3%.

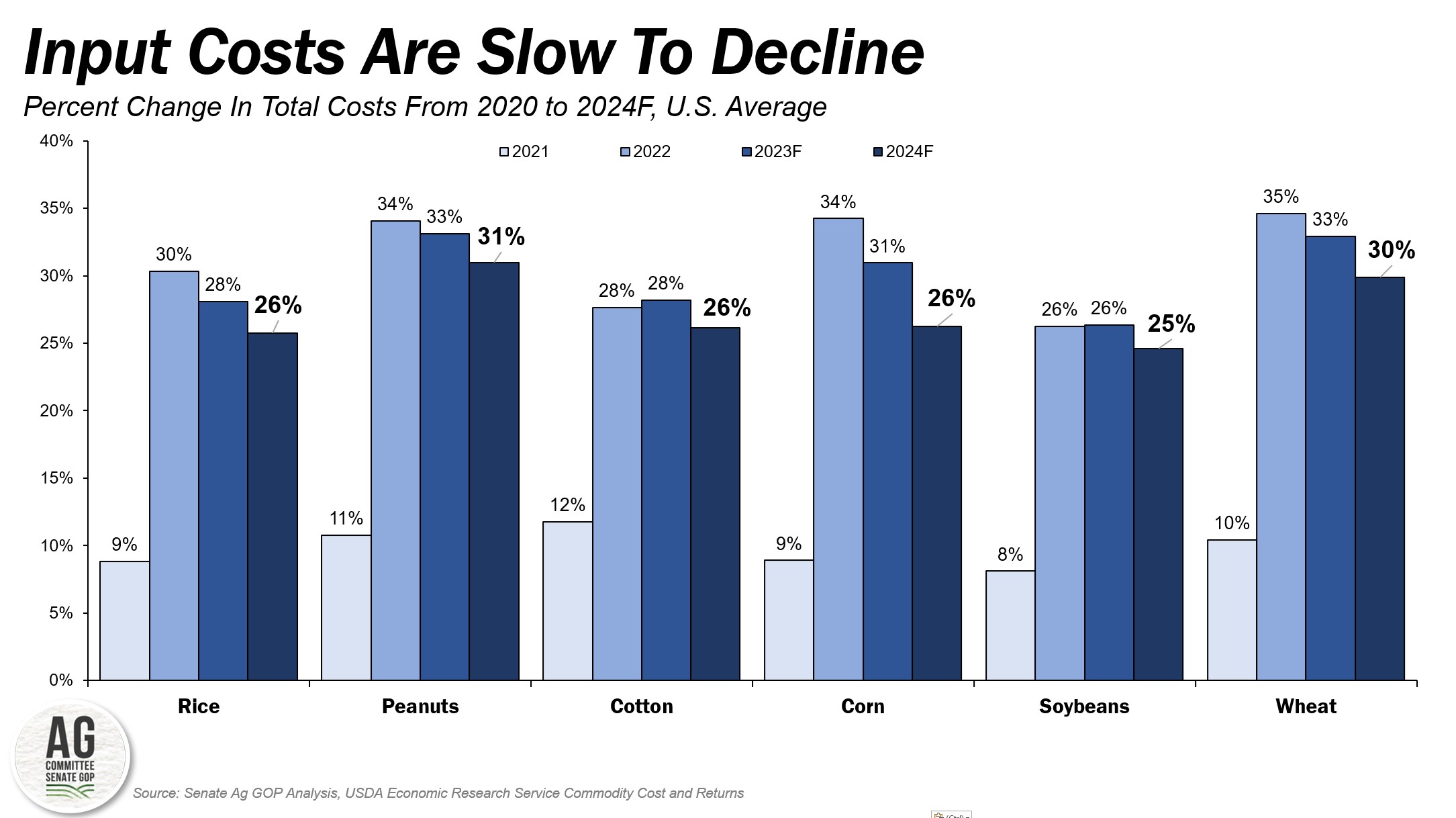

Importantly, USDA’s first look at field crop cost-of-production for 2024 shows that input costs are expected to remain elevated. Compared to 2020, peanut input costs are 31% higher; the wheat cost-of-production is 30% higher; cotton, rice, and corn input costs are 26% higher; and soybean input costs are 25% higher.

When adjusted for crop yields over time, and compared to 2020, wheat input costs are 28% higher, peanut input costs are 26% higher, rice input costs are 21% higher, corn input costs are 20% higher, the cotton cost-of-production is 19% higher, and soybean input costs are 16% higher.

If realized, USDA’s projection for elevated input costs in both 2023 and 2024 combined with weakening commodity price expectations, implies that, on average, several notable major field crops may experience marketing year average prices below breakeven levels this year and possibly into 2024.

Declining crop prices and elevated input costs highlight the importance of farm management factors such as risk management, marketing, diversification, and production efficiency that can enhance income and reduce costs – and possibly contribute to more favorable or above-breakeven margins for major field crops.